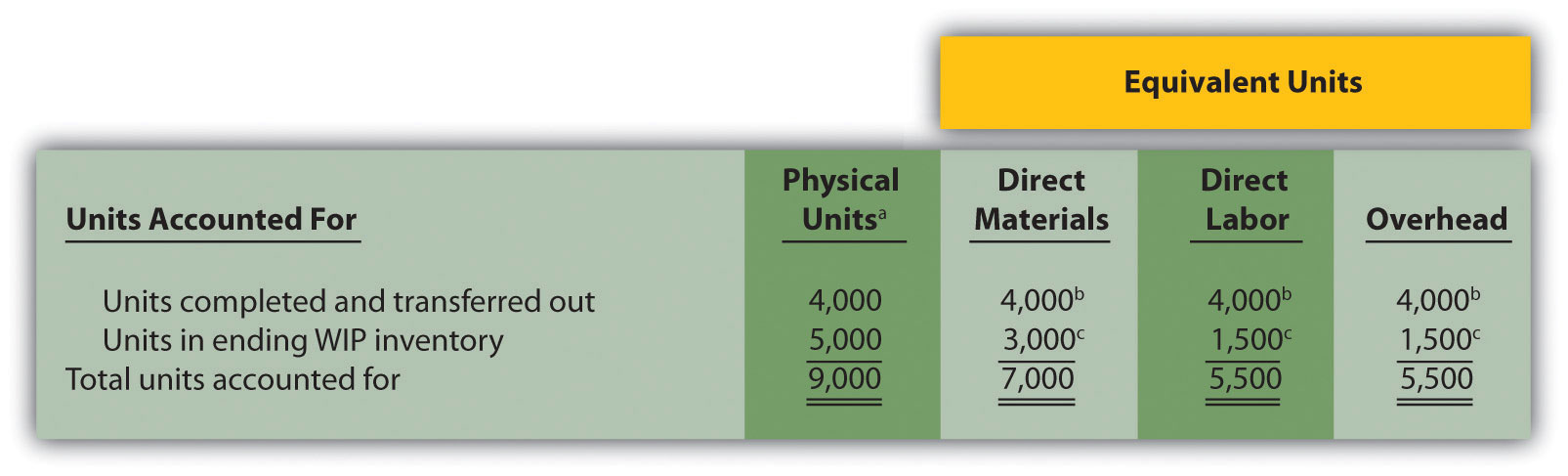

Direct material is added in stages, such as the beginning, middle, or end of the process, while conversion costs are expensed evenly over the process. Often there is a different percentage of completion for materials than there is for labor. For example, forty units that are \(25\%\) complete would be ten (\(40 × 25\%\)) units that are totally complete. For costs of units completed and transferred, we take the equivalent units for units completed x cost per equivalent unit.

Why You Can Trust Finance Strategists

Trying to determine the value of those partial stages of completion requires application of the equivalent unit computation. The equivalent unit computation determines the number of units if each is manufactured in its entirety before manufacturing the next unit. For example, forty units that are 25% complete would be ten (40 × 25%) units that are totally complete. The following example is used to demonstrate how the equivalent units of production are used to allocate production costs between completed and partially completed units.

What’s the point of process costing?

The table below summarizes the movement of physical units during the accounting period. Total costs to account for should always equal what was assigned in total costs accounted for. For example, during the month of July, Rock City Percussion purchased raw material inventory of \(\$25,000\) for the shaping department. It also assumes all beginning WIP are transferred out first (i.e. FIFO is first-in, first-out). Process costing works by tracking the costs of each step, totaling the costs, and dividing by the total number of items produced.

Which of these is most important for your financial advisor to have?

Secondly, the number of units introduced and completed in the current period should be calculated. Work-in-progress can be valued based on actual cost (i.e., an attempt may be made to find out how much materials have been used on the incomplete units and how much labor and expenses were used). Keep in mind, there are no Generally Accepted Accounting Principles (GAAP) that mandate how we must do a process cost report. We will focus on the calculations involved and show you an example of a process cost summary report but know there are several ways to present the information, but the calculations are all the same. For example, during the month of July, Rock City Percussion purchased raw material inventory of $25,000 for the shaping department. Although each department tracks the direct material it uses in its own department, all material is held in the material storeroom.

Equivalent units of production are used by a manufacturer to express partially completed units of product in terms of finished units. Equivalent units (EU) is a way to measure partially completed products as if they were fully completed. The reason we do it is because it helps to calculate the costs of products that are not yet finished at month-end or year-end.

Since the unit being produced includes work from all of the prior departments, the transferred-in cost is the cost of the work performed in all earlier departments. Equivalent units are calculated by multiply the number of physical units in work in process by the estimated percentage of completion of the units. Below you’ll find an example of a mini-lesson that helped my student, Wanda, understand how to calculate the started and completed units. For example, the closing stock of 200 units in a process, with 60% complete in respect of materials, wages, and overheads, is equivalent to 120 units (i.e., 200 x 60%), which are 100% complete. The concept of equivalent units is defined as the number of units that would have been produced given the total amount of manufacturing effort expended for a given period. Now, check your understanding of the FIFO method of computing ending and work-in-process inventory using process costing.

To illustrate more completely the operation of the FIFO process cost method, we use an example of the month of June production costs for a company’s Department B. Department B adds materials only at the beginning of processing. The May 31 inventory in Department B (June’s beginning work in process) consists of 2,000 units that are fully complete as to materials and 60% complete as to conversion. Accountants often assume that units are at the same stage of completion for both labor and overhead.

Unfinished units (work-in-process) in this department have to be converted to Equivalent Units. In this case, since materials are all added at the beginning, the Equivalent Units for Direct Materials is 100% of the actual units, but the Equivalent Units for the Conversion Costs allocation is 25% of actual units or 250 EUs. Therefore, there are a few more steps in creating the Production Cost Report. For example, if we bring 1,000 units to a 40 % state of completion, this is equivalent to 400 units (1,000 x 40%) that are 100% complete.

- In the current period, we transferred 500 units to process 2, and have 350 equivalent units in our WIP inventory.

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

- As you’ve learned, all of the units transferred to the next department must be 100% complete with regard to that department’s cost, or they would not be transferred.

- Together, equivalent units and the chosen method (either FIFO or Weighted-Average) help companies accurately calculate production costs.

- The output of a department is always stated in terms of equivalent units of production.

This involves deducting the closing work-in-progress from the amount introduced in the process during the current period. In continuous processes, there is work-in-progress at the beginning and end of a period, as well as a degree of completion of closing work-in-progress.

The cost to produce a penny is more than one cent, and yet, the United States still makes pennies. See this article from Forbes that explains the difference among cost, worth, and value to learn more. Our writing and editorial staff are a team of accounting for entrepreneurs tips to follow when starting out experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.